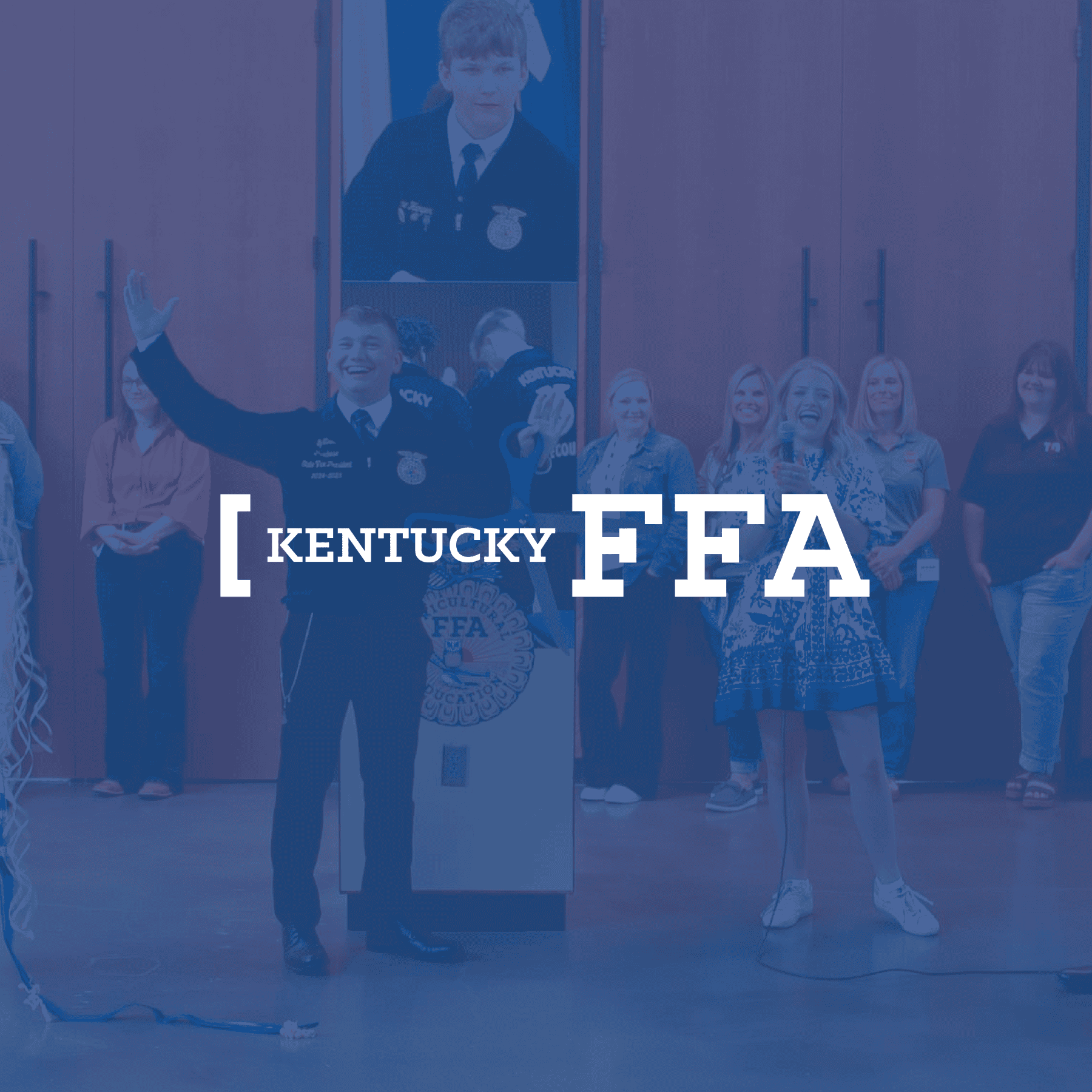

Why Give to Ky FFA?

Your support of the Kentucky FFA Foundation directly benefits FFA members by providing opportunities for leadership development, hands-on career experiences, and participation in Career Development Events. Contributions help fund programs, scholarships, and resources that allow students to grow their skills, build confidence, and prepare for future careers in agriculture and beyond. By giving, you’re empowering young people to reach their full potential, explore new opportunities, and make meaningful connections that will last a lifetime.